How to deduct your property taxes

The IRS understands that paying yearly property taxes can be difficult, and provides a tax benefit to homeowners in the form of the property tax deduction. The property tax deduction is part of a popular package of deductions offered to homeowners, including the mortgage interest deduction and deductions or credits for certain home inprovements.

Keep in mind that the property tax deduction is only available as an itemized deduction. You will need to determine if you have enough deductions available to itemize. This will be discussed in more detail later.

What property taxes can I deduct?

The property tax deduction allows you to deduct the full amount of any bona-fide property taxes paid from your taxable income as an itemized deduction, in the year you pay them. Bona fide property taxes include most of the taxes levied on your home, and may also include taxes on your car or other personal property:

- Deductible taxes must be ad-valorem - based on the value of your property

- Deductible taxes must be charged on a yearly basis (even if you pay more then once a year)

- You cannot deduct portions of your property tax that are paid towards property improvements (like levies for streets, sidewalks, or sewers)

- You cannot deduct yearly property charges for water, sewer, or trash collection (even if these charges are combined with your property tax)

Can I deduct other property taxes, like my condo fee or my car's title tax?

It depends. In order to determine whether a particular tax or fee is deductible, you must use the three qualifiers we talked about before to determine if the payment qualifies as a deductible property tax. Here are some common payments:

- Automobile Registration Fees

- In some cases, title or registration fees and other automobile-related taxes are deductible. If you must pay a yearly tax to the state or local government to keep your automobile in good standing, and that amount is based on the value of your car, you can deduct the tax as a property tax. If the amount you pay is a fixed fee, such as $100/year regardless of your car's value, it does not qualify as a property tax.

- Condo Fees

- Condo fees themselves are not deductible, but many condo fees include an amount of property tax being passed on to you by your condo association. You are permitted to deduct the portion of condo fees attributable to property taxes.

- Real Estate Transfer Taxes

- Transfer taxes (also called stamp taxes) are not considered property taxes by the IRS and therefore are not deductible. They can, however, be added to the adjusted basis of the property.

- Homeowner's Association Fees

- Homeowner's association (HOA) fees are generally non-deductible, as they are not collected by a state or local government.

How do I determine my deductible real estate tax?

If you pay your own property taxes, get your property tax statement and subtract all line items for non-deductible taxes described above. The remaining amount, which should consist of line items for city, county, and other general-use taxes, is your deductible property tax.

If you pay your property taxes as part of your monthly mortgage payments or through an escrow account, you will need to refer to the Form 1098 sent to you by your mortgage lender for the amount of property tax paid on your behalf. Federal law requires your lender to send you your 1098 no later then January 31st of each year.

Where do I deduct property taxes on my Form 1040?

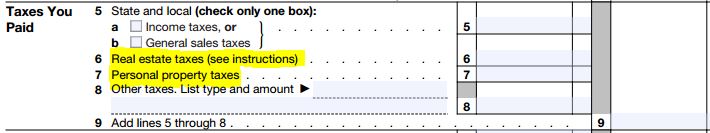

Deductible property taxes are listed on Schedule A of your Form 1040, which is used to list your itemized deductions. Lines six and seven are used for your real estate tax and personal property tax, respectively. Property taxes on your home are listed on line six, and any other deductible property taxes (such as automobile taxes, etc) on line seven.

Should I itemize in order to claim the property tax deduction?

As mentioned before, you must itemize your deductions in order to take advantage of the property tax deduction. It only makes sense to itemize your deductions if you can claim more itemized deductions than your applicable standard deduction, which you can take even if you have no itemized deductions. The standard deductions for tax year 2013 are $12,200 for a married couple, and $6,100 for single filers.

Even in a high-tax state like New Jersey or New York you'll have a hard time topping $12,200 in deductions with property taxes alone. Luckily, other itemized deductions like the mortgage interest deduction and state income tax deduction can help boost your deductions enough to make it worth itemizing.

Deducting your property taxes can really help your wallet - an individual in the 33% tax bracket will save almost $2,000 by deducting their $6,000 property tax bill!

Learn more in the Property Tax FAQ